Across the cybersecurity sector, a paradox is emerging.

Risk is rising. Spend remains material. Yet growth is slowing, and margins are under pressure.

This is not a demand problem. It is a decision problem.

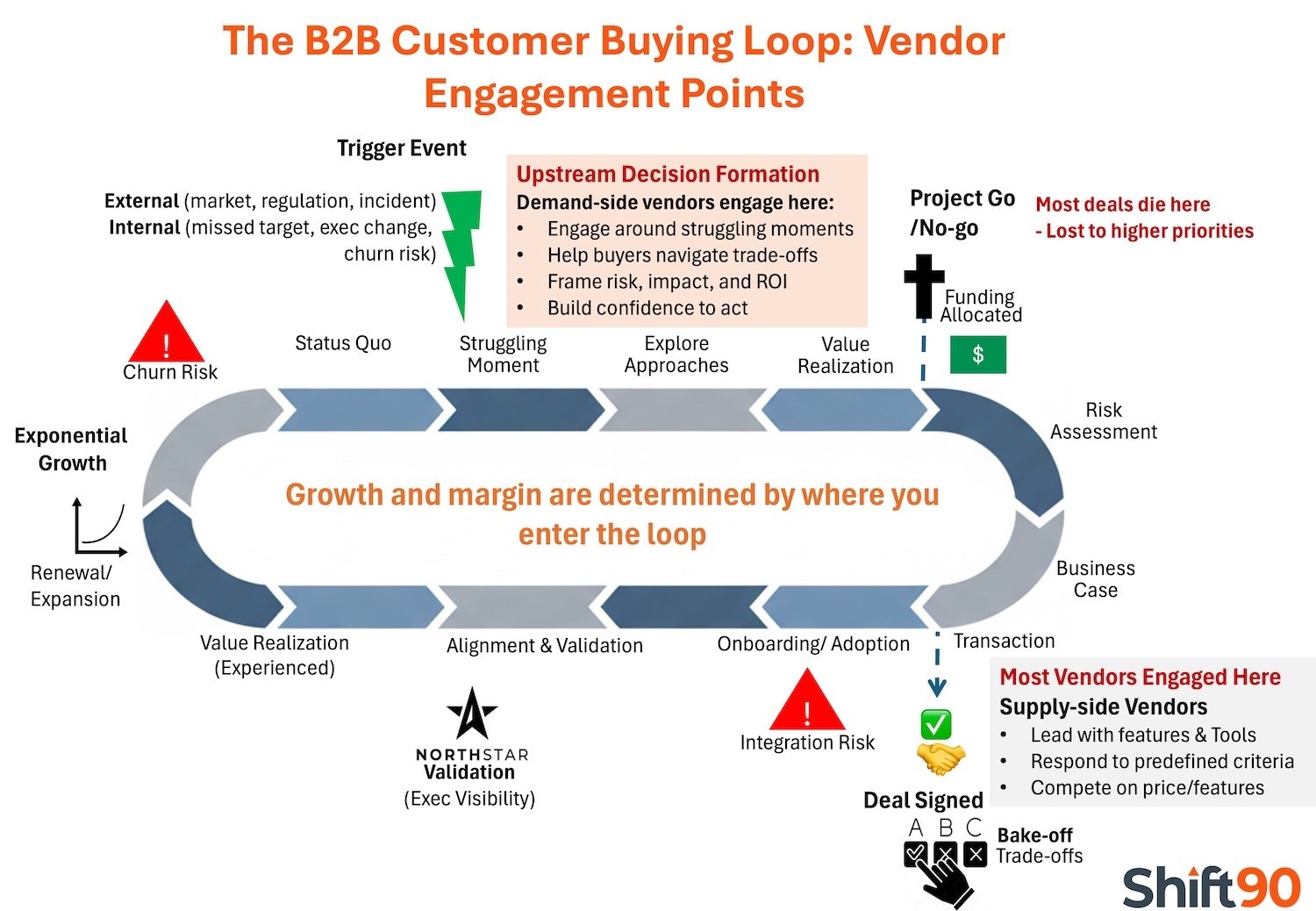

The World Economic Forum’s Global Cybersecurity Outlook 2026 crystallises a pattern now visible across enterprise cybersecurity markets: buying decisions are being made earlier, internally, and in economic terms, often before vendors are meaningfully engaged.

What many cybersecurity companies are experiencing individually, stalled deals, longer cycles, late-stage price pressure, and collapsing expansion revenue, is in fact a shared market shift in how cyber investment decisions are now formed.

Buyers Are Deciding Earlier and Without Vendors

In enterprise organisations, cybersecurity decisions increasingly start upstream, before vendors are engaged.

Internal conversations now focus on:

-

Where the organisation is over- or under-invested

-

What can be consolidated safely

-

How cyber risk should be prioritised economically

-

How to justify spend to finance and the board

By the time vendors enter the conversation, the most consequential decisions have often already been made: the category, the budget envelope, and the framing of success.

Vendors are not losing to better products. They are arriving after decision logic has been set.

AI Has Accelerated the Shift

The rise of AI has pushed cyber risk discussions further up the organisation. Boards and executive teams are no longer asking purely technical questions. They are asking economic ones:

-

What exposure actually matters?

-

What risks are increasing fastest?

-

What should we stop funding to make room for what matters most?

These are prioritisation and trade off decisions, not product evaluations. As a result, most vendors are not engaged at the point where investment logic is being formed and are drawn into the process later, once initiatives are already defined.

At that stage, technical teams increasingly use AI-assisted tools to short list vendors alongside incumbents for formal evaluation. Engagement typically occurs through procurement and operational cyber management rather than executive leadership.

By the time vendors are involved, the scope, success criteria, and budget envelope are largely fixed. What remains is comparison, validation, and negotiation.

Consolidation Is Redefining “Value”

Enterprise buyers are actively rationalising cybersecurity stacks due to cost pressure, skills shortages, and operational fatigue.

“Best-in-class” has lost ground to “fewer vendors, fewer tools, fewer handoffs.”

This shift compresses margins for vendors who only engage once consolidation criteria are already defined. At that point, differentiation collapses and pricing becomes the primary lever.

Why This Hits Growth and Margin at the Same Time

These changes create a compounding effect:

-

Late engagement reduces influence

-

Reduced influence increases competitive pressure

-

Competitive pressure compresses price

-

Longer cycles increase cost of sale

-

No-decision outcomes waste pipeline capacity

The result is slower growth and thinner margins, even as cyber risk and spend remain elevated.

The Root Cause Is Not Sales Discipline

Most vendors respond by doubling down on execution: qualification rigour, forecasting accuracy, CRM enforcement.

These tools improve visibility, but they do not change outcomes if the underlying buying logic is misaligned.

Operational discipline scales whatever logic it is given. If that logic reflects how vendors want buyers to buy rather than how buyers actually decide, scale amplifies inefficiency.

The Missing Step: Validating Buyer Decision Logic

The common gap across the sector is a lack of validated understanding of how the best customers actually reached a decision.

Not why sales thinks they won.

Not what the product does.

But what triggered change, what nearly stopped it, and what made the decision defensible internally?

Without this, vendors optimise for downstream execution while buyers struggle upstream to align internally.

The Consequence

Cybersecurity companies are not facing a collapse in demand. They are facing a misalignment between how they go to market and how decisions are now made.

Until this gap is addressed, growth will continue to slow, margins will remain under pressure, and increasing sales discipline alone will fail to reverse the trend.

The market has moved upstream. Most vendors have not.