Top-down brand invention still follows a Mad Men script.

Not the whisky and typewriters.

The workshop.

It usually begins the same way — often right after a funding round.

New capital.

New expectations.

New ambition.

And suddenly the question becomes: “What do we want to be known for?”

There’s energy in the room.

A bright spark.

A visionary.

Someone inspired to elevate the company.

To modernise it.

To reposition it.

To make it “category-defining.”

The intention is good.

The energy is real.

But aspiration is not differentiation.

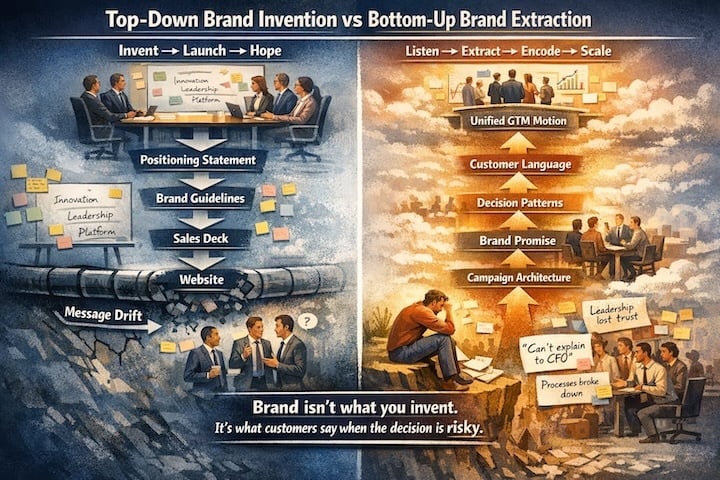

For decades, companies have built brands the same way... and the chances are your recent rebrand followed this pattern.

Lock executives in a room.

Analyse competitors.

Find “white space.”

Invent differentiation.

Six months later, you have fresh messaging.

Refined positioning statements.

New visual identity guidelines.

And a sales team quietly rewriting everything.

Because what was invented in a boardroom rarely survives a real buying conversation.

The Hidden Cost of Intended Positioning

The hidden cost of intended positioning is subtle.

It sounds like everyone else.

Platform. Innovation. Leader. Intelligent. End-to-end. AI-powered, Game-changing, Streamlined, Supercharged!

Language is designed to inspire internally, but is indistinguishable externally.

So the brand enters the market not as signal, but as noise.

Lost in the cacophony of crowded categories.

Drowned out by identical claims.

Competing on volume instead of clarity.

Top-down positioning rarely fails because it is incorrect. It fails because it is generic.

It was invented in a boardroom, not extracted from a buyer under pressure.

Brand as Crude Oil

Here’s the mistake.

Most companies treat a brand like an invention.

In reality, it’s a resource.

When customers decide to buy, they generate something incredibly valuable: language.

They describe their struggle.

They describe what nearly stopped them.

They describe what changed internally.

They describe what made the decision defensible.

That language is crude oil.

Raw. Emotional. Risk-laden.

Unpolished — but immensely valuable.

Most companies ignore it.

They sit on reservoirs of customer truth and instead choose to manufacture positioning from scratch.

Then they wonder why the market doesn’t respond.

What Buyers Actually Say

When you interview customers who recently chose you and ask:

“What were you struggling with when you decided to change?”

The answers are rarely abstract.

They are specific. Human. Political.

-

“We couldn’t explain our decisions to leadership.”

-

“The wheels were starting to come off.”

-

“We were losing credibility internally.”

-

“We couldn’t justify the status quo anymore.”

Notice what’s missing.

No one says:

“We needed an end-to-end AI-powered optimisation platform to streamline profitability.”

Buyers don’t describe their world in product categories.

They describe struggling moments.

That is where real positioning lives.

Bottom-Up Brand Extraction

Bottom-up brand extraction reverses the flow.

Instead of:

Boardroom → Positioning → Campaign → Hope

It becomes:

Struggle → Language → Decision Pattern → Brand Promise → Scale

You don’t invent differentiation.

You extract it. You refine it.

Like oil pulled from the ground and distilled into fuel, raw customer language is processed into a clear, coherent brand promise.

When you extract positioning from real decision stories, several things change:

The brand promise reflects a problem buyers recognise instantly.

Marketing campaigns attach to trigger events, not abstract claims.

Sales conversations begin with struggle, not solution.

Internal alignment improves when everyone uses customer language.

Positioning is not invented.

It is refined.

Then encoded, as a commercial system that survives scale.

Why This Matters More After Funding

This is especially critical after a funding round or acquisition.

Capital increases expectations.

Targets rise.

Hiring accelerates.

And pressure to “elevate the brand” intensifies.

But scaling invented positioning amplifies inconsistency.

Scaling extracted positioning amplifies clarity.

The difference is structural.

One is aspiration-led.

The other is evidence-led.

One hopes the market will respond.

The other is built on how the market already decided.

From Noise to Signal

The market does not reward ambition.

It rewards recognition.

When buyers see their own struggle reflected back at them in language they already use, trust accelerates.

Decision friction reduces.

Internal justification becomes easier.

That is differentiation.

Not because you claimed it.

But because buyers recognise it.

Brand is not what you want to be known for.

Brand is what customers say when the decision is risky.

You are either inventing positioning. Or extracting it.

One produces guidelines.

The other produces growth.

Three Questions to Consider

Before your next rebrand, ask:

- Are we inventing how we want to be seen — or extracting why buyers actually chose us?

- Does our positioning reflect internal ambition — or real decision pressure?

- If we scaled this messaging tomorrow, would it amplify clarity — or amplify noise?

If you are unsure, your brand may be aspiration-led, not decision-led.

Call to Action

If you want a fast assessment of whether your brand is invented or extracted:

Comment “Brand?”

We’ll share a short diagnostic to evaluate:

No pitch. Just signal.

Because brand is not what you hope the market believes.

It is what buyers say when the decision feels risky.

And that signal can be refined.